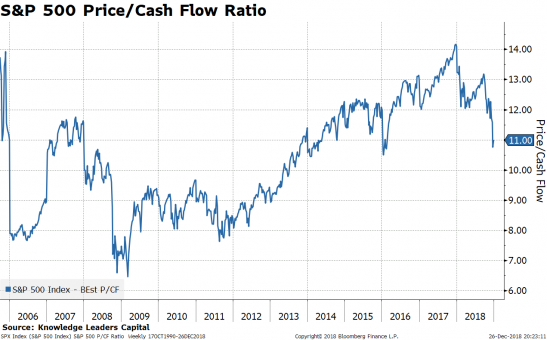

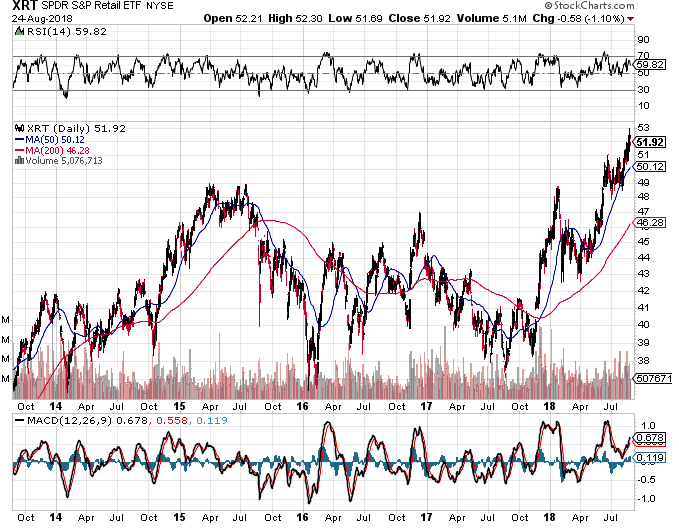

Santa's Gift to Investors: Global Oversold Conditions Present Buying Opportunity - Knowledge Leaders Capital

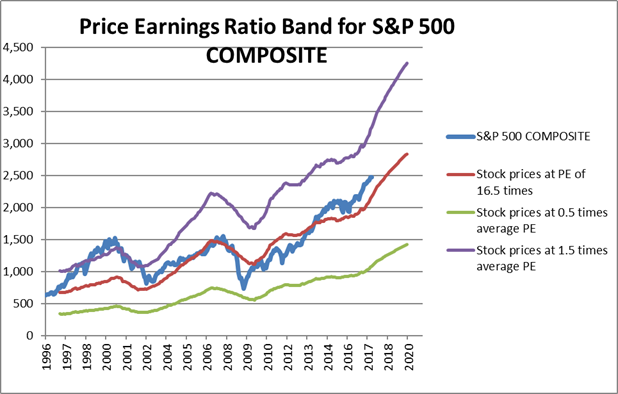

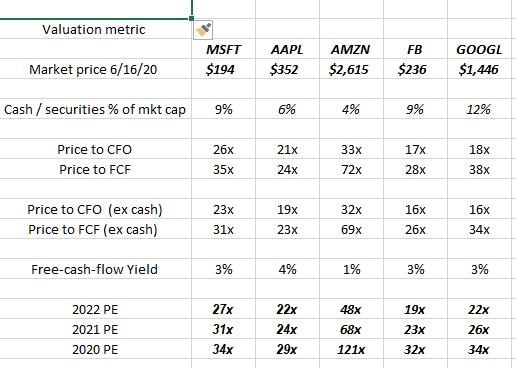

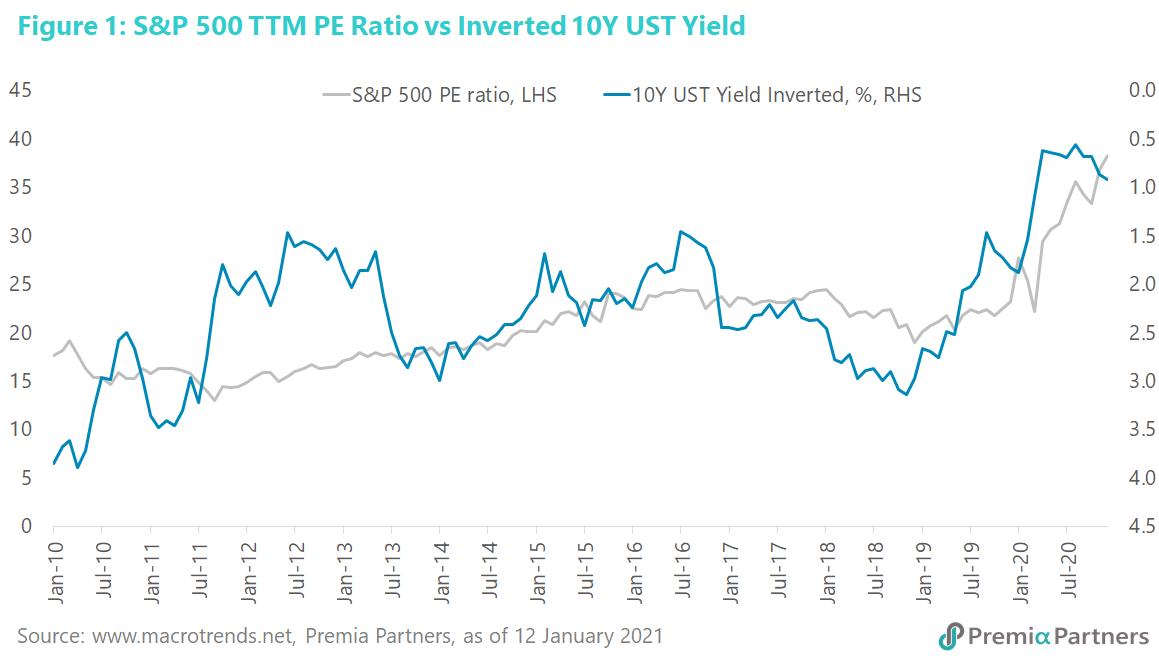

Is the S&P 500 severely overvalued? Look from five different angles! – ProThinker – Analytics for Informed Decisions

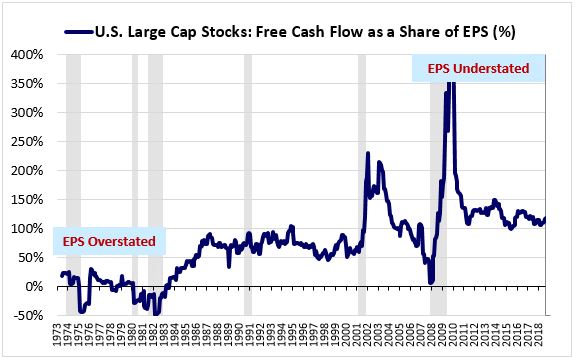

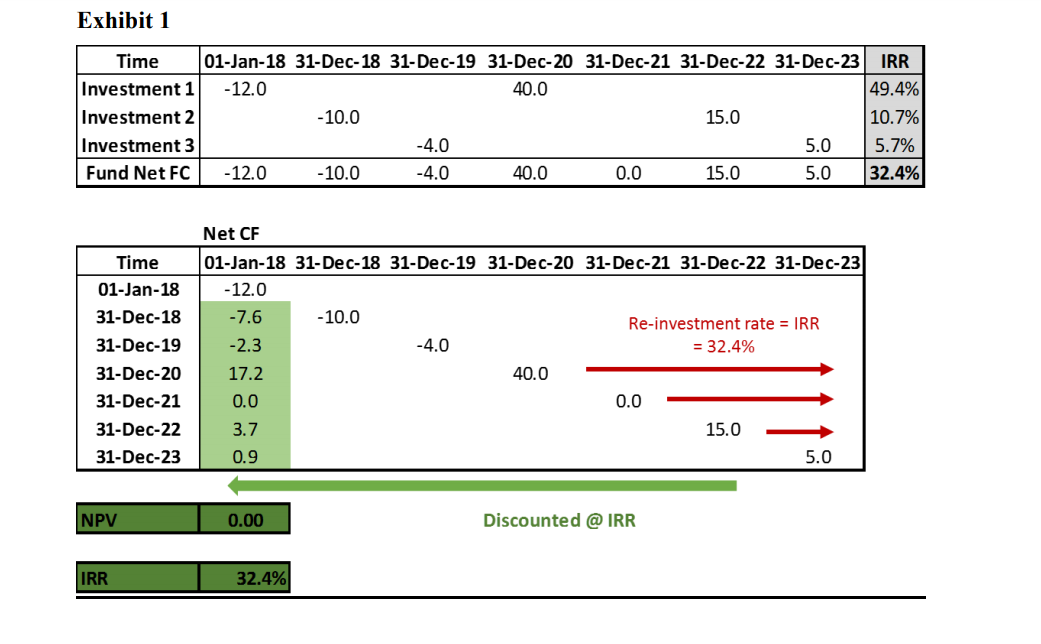

The Earnings Mirage: Why Corporate Profits are Overstated and What It Means for Investors | O'Shaughnessy Asset Management

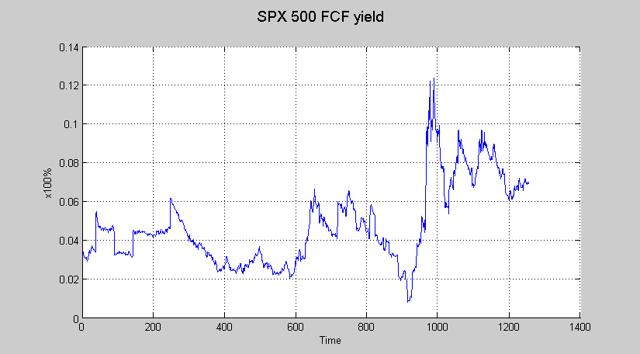

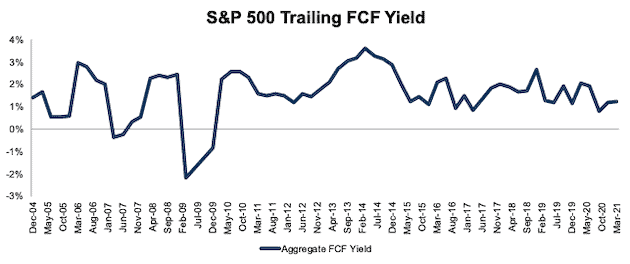

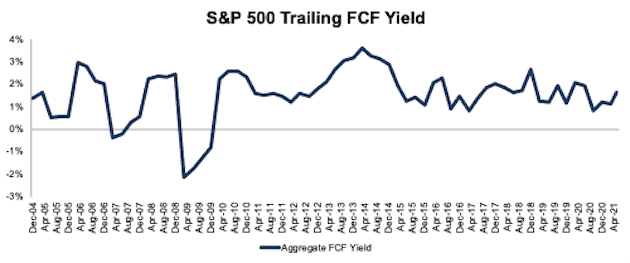

A Quick Look At The S&P500 Free Cash Flow. As Long As The Real Economy Remains On-Track, Expect Healthy Corrections, Not Protracted Bear Markets. | Seeking Alpha

:max_bytes(150000):strip_icc()/TopETFsthroughDec.22021-7388ec5349294c67b33dc6dc2cb8e171.png)

/Untitled-1-d0efd4e7b7ae44c4827bcfa4976a4629.png)