Elements of Financial Risk Management Second Edition © 2012 by Peter Christoffersen 1 Simulating the Term Structure of Risk Elements of Financial Risk. - ppt download

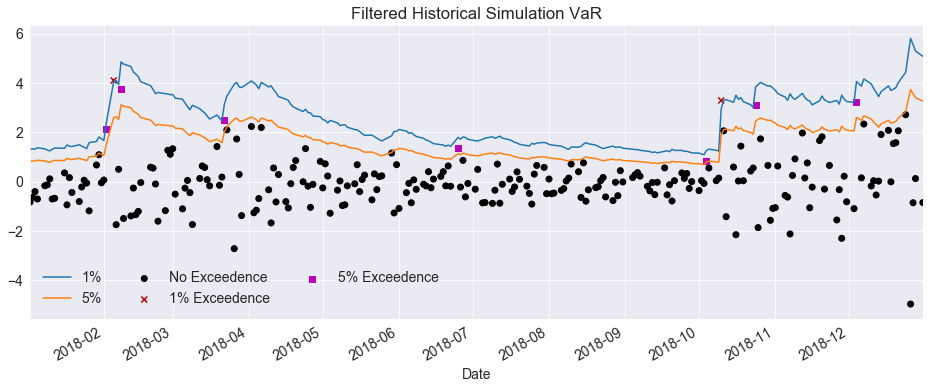

Using Bootstrapping and Filtered Historical Simulation to Evaluate Market Risk - MATLAB & Simulink Example

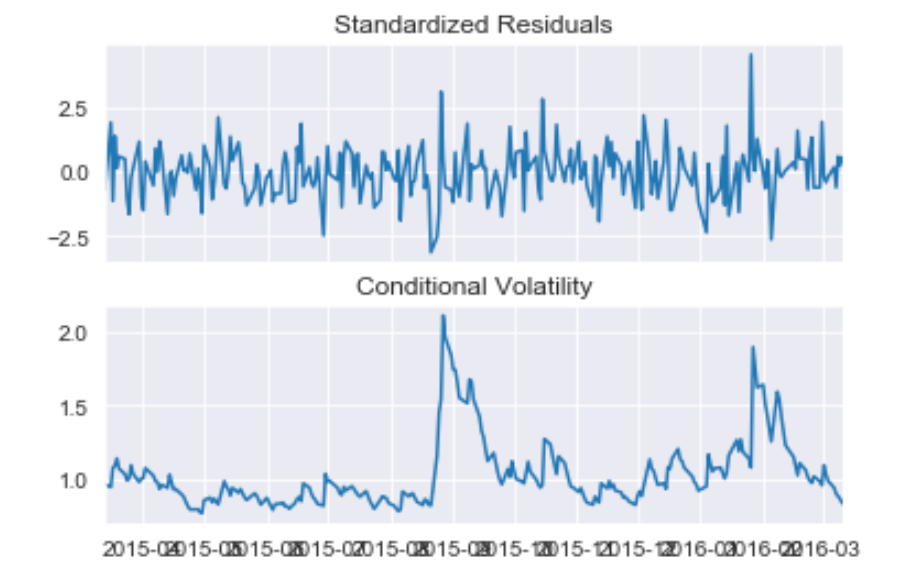

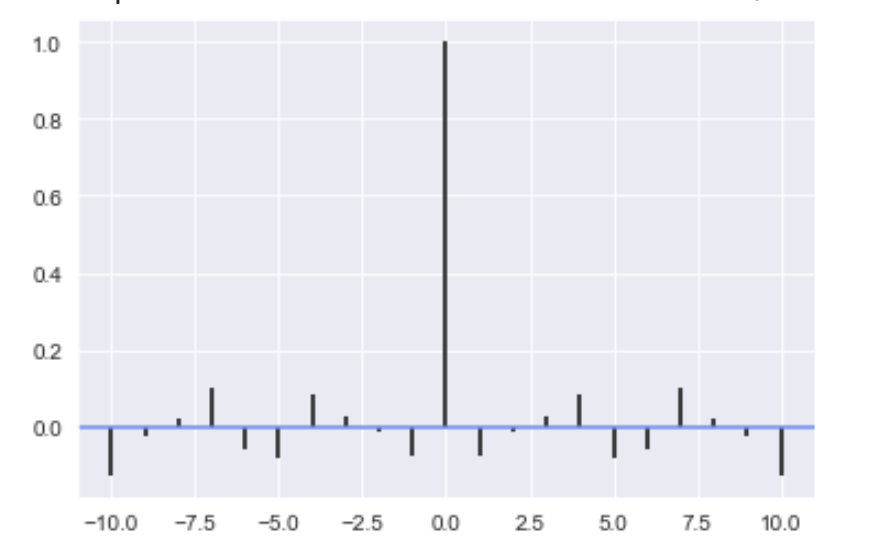

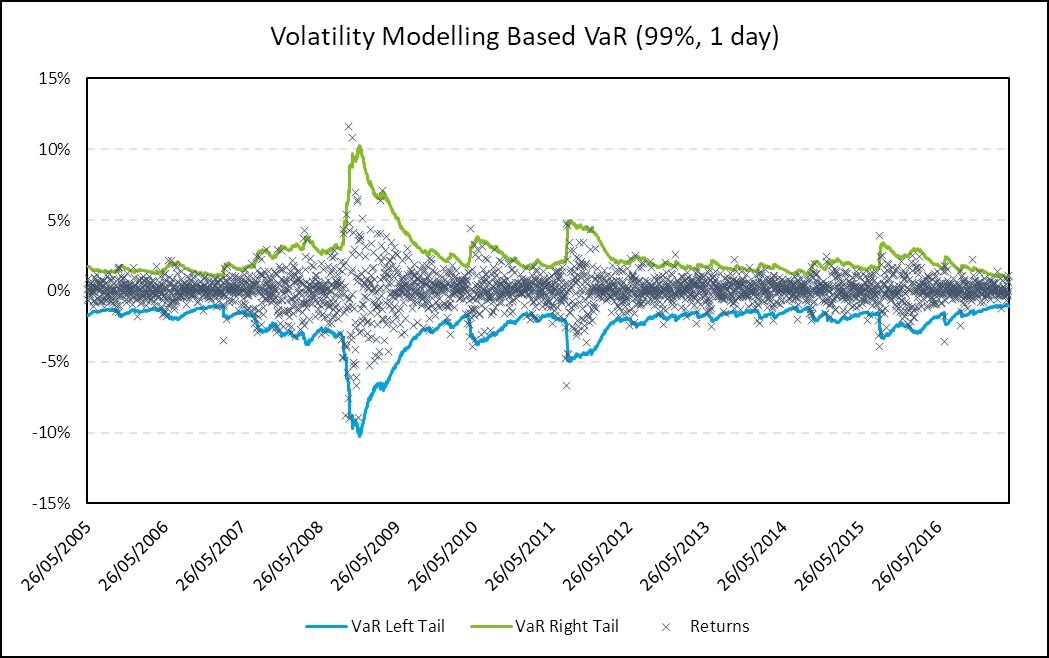

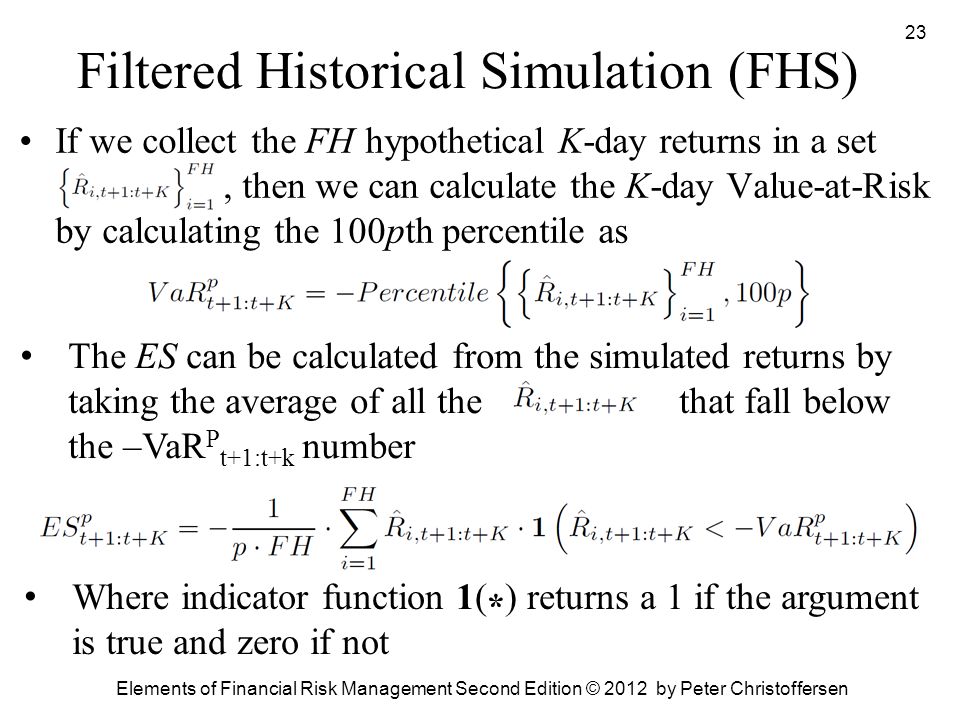

Random walk model (Exponentially Weighted Moving Average, EWMA), Integrated GARCH-RiskMetrics VaR, Generalised Autoregressive Conditional Heteroskedasticity (GARCH) models, Filtered historical simulation (FHS), Example 1: Estimating daily 95% VaR with ...

On the application of Filtering Historical Simulation to the HAR-RV for VaR forecasting | Semantic Scholar